This blog explores the significance of Annual General Meetings (AGMs) for companies, outlining their role in corporate governance, shareholder engagement, and regulatory compliance. Learn why AGMs are vital for transparency, accountability, and long-term success.

By Guruvind TanwerAug 15, 20248 mins read

This blog explains Form INC 20A, a mandatory declaration for starting a business in India. Learn why it's important, the consequences of non-filing, and the steps to submit it, ensuring your new business stays compliant and avoids penalties.

Stay compliant with Indian corporate regulations by understanding MGT-7 and AOC-4. This blog explains the essential annual forms' importance, requirements, and filing procedures, including due dates and key elements. Learn how to ensure your company's financial transparency and operational accountability.

This blog provides an in-depth guide on the DIN KYC (Director Identification Number Know Your Customer) process in India, covering its importance, due dates, consequences of non-compliance, required documents, and step-by-step filing procedure. It aims to help directors ensure compliance with MCA regulations and maintain their DIN status.

This blog provides a comprehensive guide on how to close a company, covering the necessary steps, types of closures, criteria, potential benefits, regulations in India, common mistakes to avoid, and FAQs. It aims to help business owners easily navigate the complex process of company dissolution.

Understanding the distinct roles and responsibilities of directors and shareholders is crucial. This blog delves into the key differences between directors and shareholders, focusing on their roles, responsibilities, legal obligations, and decision-making powers within the framework of Indian laws.

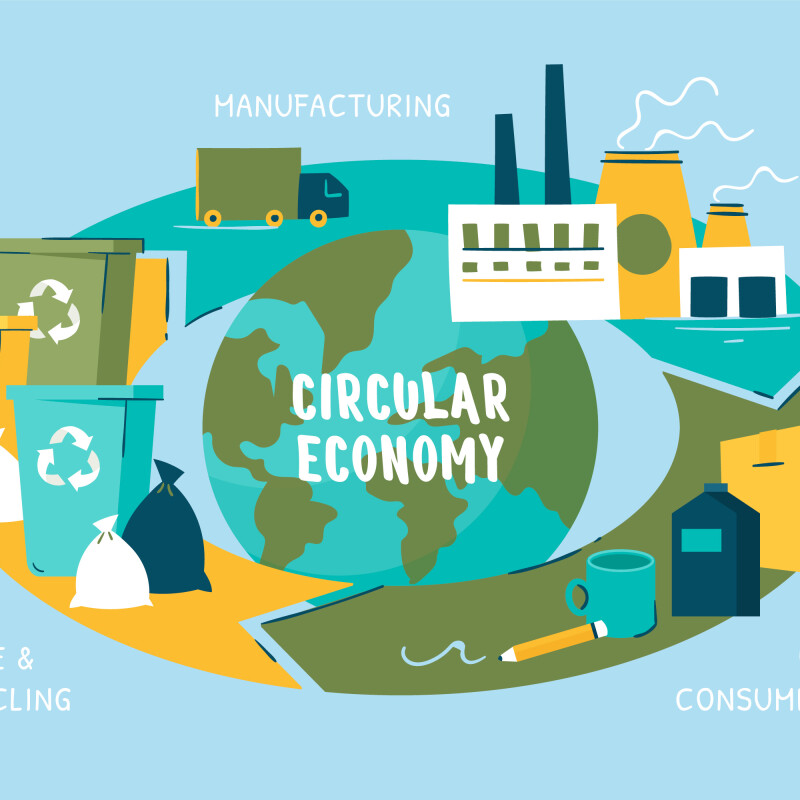

This blog delves into the circular economy, a sustainable business model designed to address the limitations of the traditional linear economy. It explores the core principles, various business models, and the challenges and opportunities associated with transitioning to a circular economy. Discover how embracing circular economy principles can lead to innovation, cost savings, and a competitive e

This blog explores the unique characteristics and values of Generation Z, born between the late 1990s and early 2010s. It delves into their core values, behaviors, and expectations, offering insights on how businesses can effectively market to this emerging consumer group. Discover how Gen Z's distinct mindset is reshaping industries and challenging traditional marketing strategies.

This blog delves into the significance of sustainable business practices, emphasizing their role as a cornerstone of corporate responsibility. It explores how sustainability drives innovation, enhances brand reputation, and mitigates risks, while providing practical insights into key areas of focus for businesses.

This blog explores the dual nature of Artificial Intelligence (AI) in the workplace, examining its potential to enhance efficiency and innovation while addressing concerns about job displacement and ethical implications.

This blog provides a comprehensive guide on the do's and don'ts before incorporating a new company. It offers essential tips and advice to help entrepreneurs make informed decisions and avoid common pitfalls during the incorporation process.

Discover how businesses of all sizes can harness the latest technological advancements to streamline operations, reduce costs, and drive growth. From automation and cloud computing to AI and data analytics, we explore practical strategies and real-world examples to help you optimize your business performance. Stay ahead of the curve with insights on emerging technologies and expert advice.

ESIC (Employees State Insurance Corporation)

ESIC is a comprehensive social security and health insurance scheme managed by the Employees' State Insurance Corporation, under the Ministry of Labour and Employment. It provides financial support and medical benefits to employees and their dependents during times of need, such as sickness, maternity, disablement, or death due to employment-related injuries.

Why ESIC Registration is Mandatory:

ESIC registration becomes mandatory for businesses under the following criteria:

Employee Threshold: Businesses with 10 or more employees (in some states, this threshold may vary to 20 employees) must register under ESIC. This requirement applies to employees earning ₹21,000 or less per month.

Legal Obligation: Employers are required to register under the ESIC Act within 15 days of reaching the eligible employee threshold. Non-compliance can lead to penalties and legal repercussions.

Employee Benefits: Registered employees gain access to a range of benefits, including medical care, sickness benefits, maternity benefits, and more. ESIC ensures that employees receive necessary support during times of illness or injury, thereby enhancing their welfare and productivity.

PF (Provident Fund)

PF is a savings scheme aimed at providing financial security to employees after their retirement. Managed by the Employees' Provident Fund Organisation (EPFO), PF contributions are mandatory for eligible employees and employers.

Why PF Registration is Mandatory:

PF registration is compulsory for businesses under the following criteria:

Employee Threshold: Employers with 20 or more employees are required to register for PF contributions. This applies to employees earning up to ₹15,000 per month, though higher-earning employees can voluntarily opt for PF.

Contribution Requirements: Both the employer and employee contribute a fixed percentage (currently 12% each) of the employee's basic salary, dearness allowance, and retaining allowance to the PF account every month. These contributions accumulate over time to provide a lump sum amount to the employee upon retirement or resignation.

Legal Compliance: Employers must register with the EPFO and obtain a PF registration number. They are also required to file monthly PF returns and maintain accurate records of contributions and withdrawals. Compliance ensures transparency and accountability in managing employees' retirement savings.

Benefits of Compliance:

Complying with ESIC and PF registrations offers several benefits to businesses:

Legal Compliance: Ensures adherence to labor laws and regulatory requirements, avoiding penalties and legal issues.

Employee Welfare: Demonstrates commitment to employee well-being by providing access to healthcare and retirement benefits.

Organizational Credibility: Enhances the reputation of the business as a responsible employer, fostering a positive work environment and employee loyalty.

Conclusion

ESIC and PF registrations are not just legal obligations but essential components of responsible business operations in India. By registering under ESIC and PF, businesses uphold their commitment to employee welfare and statutory compliance, contributing to a productive and harmonious workplace environment.

For businesses navigating the complexities of ESIC and PF registrations, consulting with HR professionals or legal experts specializing in labor laws can provide invaluable guidance. Understanding and fulfilling these obligations not only mitigate risks but also empower businesses to focus on their core objectives while nurturing a supportive and compliant workplace culture.

For more queries and updates join our Whatsapp community